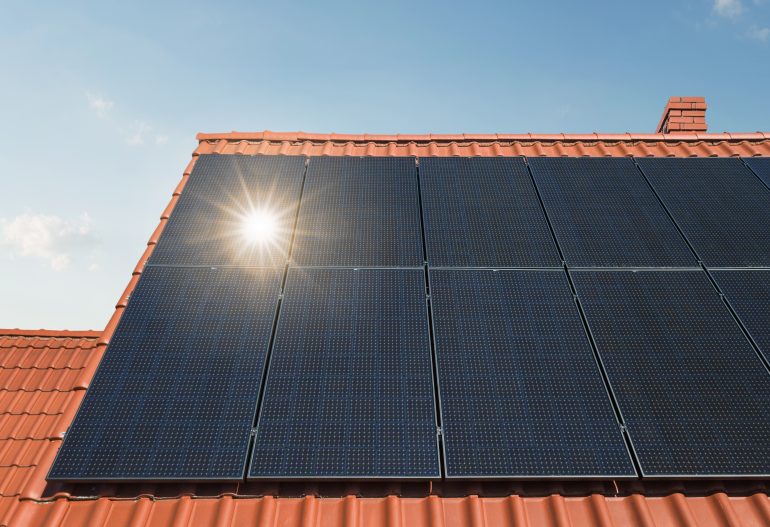

Electricity rates are increasing considerably each year. As a result, going solar is top-of-mind for many homeowners. The cost of electricity is at an all-time high, while the cost of solar installation is at an all-time low–particularly with the availability of government tax incentives.

When exploring solar, one of the first questions a homeowner has is: Do we lease, or do we buy? While there is definitely a more advantageous choice, homeowners should do their due diligence to understand what each option offers.

Leasing

Leasing solar equipment is easily equated to renting an apartment versus owning a home. Your monthly rent payments are lower than a mortgage and a 20% down payment isn’t needed—but the property is owned by a third party.

Solar works in much the same way, offering an opportunity to leverage solar energy without a large initial investment and higher monthly payments. Even without owning the equipment, your electric bills will experience a sharp dive along with your carbon footprint.

However, while leasing solar equipment results in the lowest monthly payment, you end up paying more over time and won’t benefit from a boost in property value—much like renting an apartment. In addition, many homeowners are not informed that solar leases come with a rate escalation of up to 2.9% each year, the government tax credit goes to the leasing company instead of the homeowner, and there are possible complications when you sell your home.

Owning

Purchasing solar panels offers the lowest total cost of solar. For those who have enough savings or home equity to pay cash for the installation of their system—owning is a natural path toward solar. This is especially true if you plan to stay in the home for another 20-30 years– offering the best solar payback period and providing you with a substantial home value increase if you eventually sell.

Solar ownership is a win-win for homeowners because the service is easily transferable and it offers an identical warranty to leasing. In addition, homeowners can benefit from 15 years of free power, considering the average lifespan of a solar system is 40 years and the typical payback period is 25 years.

A significant added bonus of owning your solar panels is that if you qualify, government tax credits belong to you, the homeowner, instead of the leasing company. If you don’t qualify, a common workaround is creating an LLC so you can sell the credits and leverage the tax credit.

At Smart Green Solar, we believe buying beats leasing because it enables you to pay less for your solar system over time, take advantage of government tax credits, and enjoy free solar once your solar system is paid off. Leasing is an option, but after conducting due diligence, most homeowners determine that purchasing their solar panels offers their best return on investment.

Considering solar? Use our Solar Savings Calculator to obtain a custom solar savings estimate for your home. We invite you to learn more about Smart Green Solar, our core values and our unique approach–which has led to us becoming a leading full-service provider in Rhode Island, Massachusetts, and Connecticut.